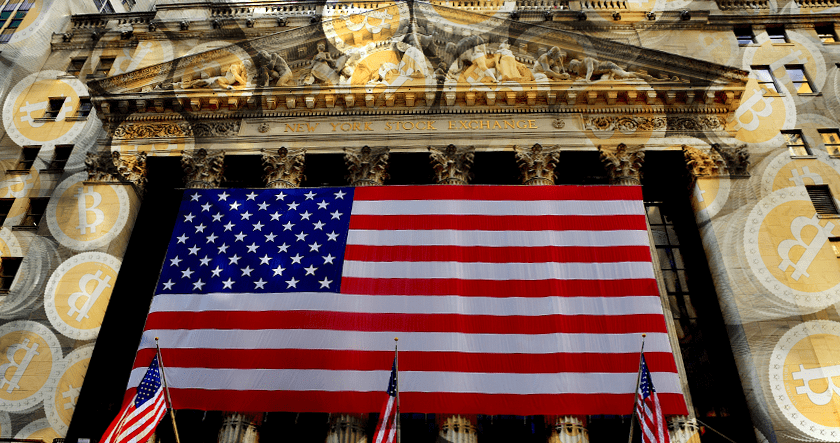

The Treasury Department is about to announce its first international cryptocurrency action, revealing which countries the U.S. is targeting with its new regulations and guidance. Here’s what you need to know.

The U.S. government has long been concerned about the growing use of cryptocurrencies across the world, particularly as they become increasingly popular in areas like Latin America and Southeast Asia. In an effort to tackle the issue more proactively, the Treasury Department announced on Monday that it will be issuing new regulations and guidance on international cryptocurrencies in the coming weeks.

The U.S. government is targeting a wide range of countries with its new measures, including countries that are home to cryptocurrency exchanges, governments that have adopted cryptocurrency technologies, and emerging markets where digital assets are gaining traction due to lack of existing financial infrastructure or access restricted by current governments or domestic banking monopolies. The efforts are intended to encourage responsible behavior in these countries while helping spur growth in legitimate financial sectors and investments in safer assets such as long-term securities or commodities backed bonds.

The most immediate effect of the Treasury’s proposed regulations could be seen through enforcement activities against companies or people engaged in illicit transactions involving digital assets located overseas that facilitate any money laundering activities—including drug trafficking, terrorism finance, corruption payments, ransomware payments, tax evasion schemes and transactions originating from sanctioned entities or countries subject to US economic sanctions (such as North Korea). This could potentially put some families at risk if their low-level business deals involved minor illegal activity related to virtual currency abroad but not led an arrest/prosecution domestically due to lack of clarity around legitimacy thresholds and minimal resources allocated for law enforcement investigations into these activities abroad

In addition to these types of immediate actions, longer-term implications may also arise from the announcement related investment opportunities abroad including bond offers backed by cryptocurrencies and currency swaps between different nations using digital tokens as collateralized debt instruments instead of traditional fiat currencies — all giving investors greater exposure than they would ordinarily get compared with stock market investors based in one country alone . It remains unclear whether such offerings will actually materialize given potential difficulties associated with implementation across multiple jurisdictions – but development could theoretically pave the way for another form of liquidity sources beyond volatile bitcoin market prices currently operating outside legal regulatory frameworks completely .

Treasury Secretary Steven Mnuchin said he expects other major economies and central banks around the world will eventually follow the US lead implementing similar actions to track illicit traders internationally , noting “I think you’ll see more people following us”. As we wait further action outgrowth announcement , only time tell if speculation proves correct this globalization trend starts gaining ground eventually signaling wider acceptance virtual coinage global investing–questions which seem sure stay top agenda least foreseeable future when comes either keeping criminals check modernizing money systems our nation relying .